Vontobel AM mit neuem Chef für Multi-Asset-Strategien | Finanzprofis | 12.12.2018 | FONDS professionell

Vescore-Chef analysiert die von den Term Spreads ausgehende Gefahr | Märkte | 02.08.2018 | Institutional Money

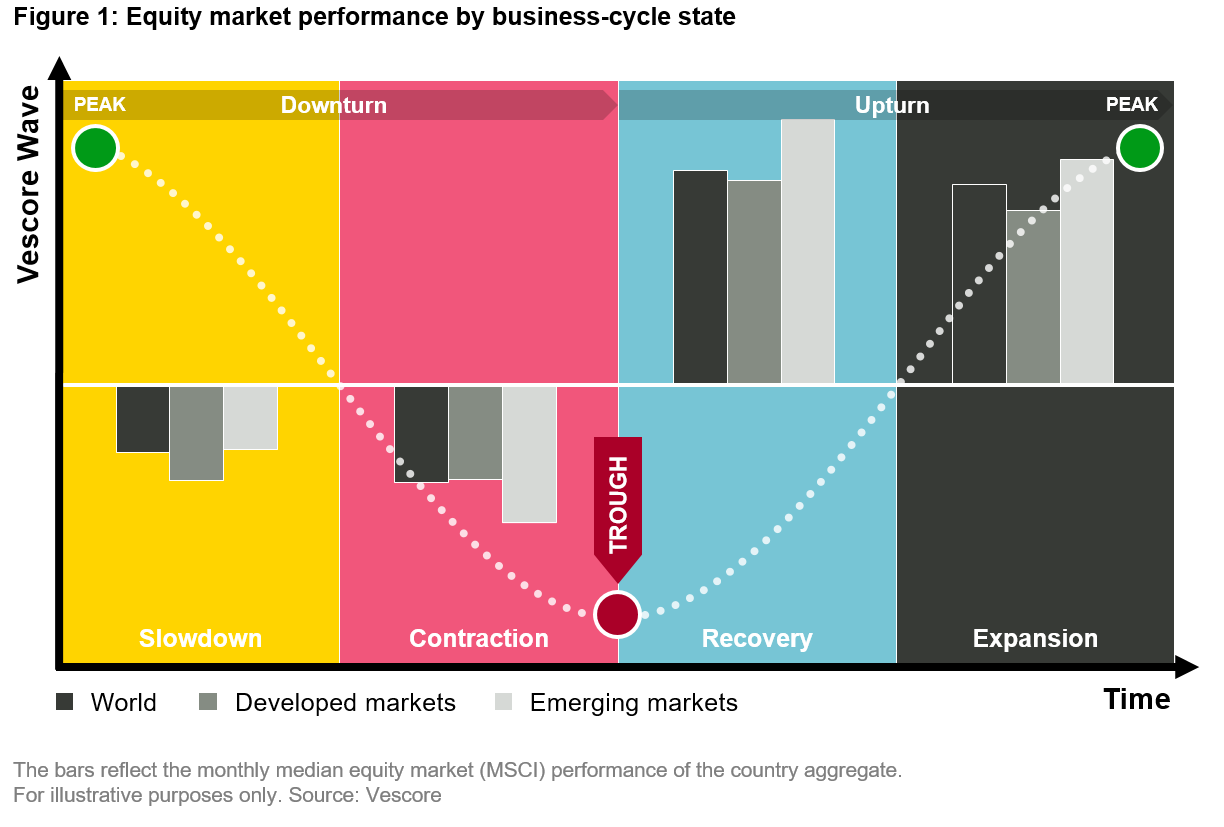

Market Narratives | The invincible core, correlations and the discipline of a multi-asset portfolio | Daniel Seiler